Home

Breaking News

-

Bitcoin Falls 8%, Drops Below $62K Before Rebound

Bitcoin and the broader cryptocurrency market fell nearly 10% on Saturday. Bitcoin and the broader cryptocurrency market fell nearly 10% on… Read more

-

Coinbase Seeks to Take Core Question in U.S. SEC Case to Higher Court

Coinbase is seeking to rip the bandage off of a legal impasse at the center of the crypto industry’s fight… Read more

-

Bitcoin Plunges to $66K, Altcoins Tumble 10-15% on Ugly Day for Risk Assets

Investors may expect market weakness due to the tax season, Ryze Labs said in a report. Investors may expect market weakness… Read more

-

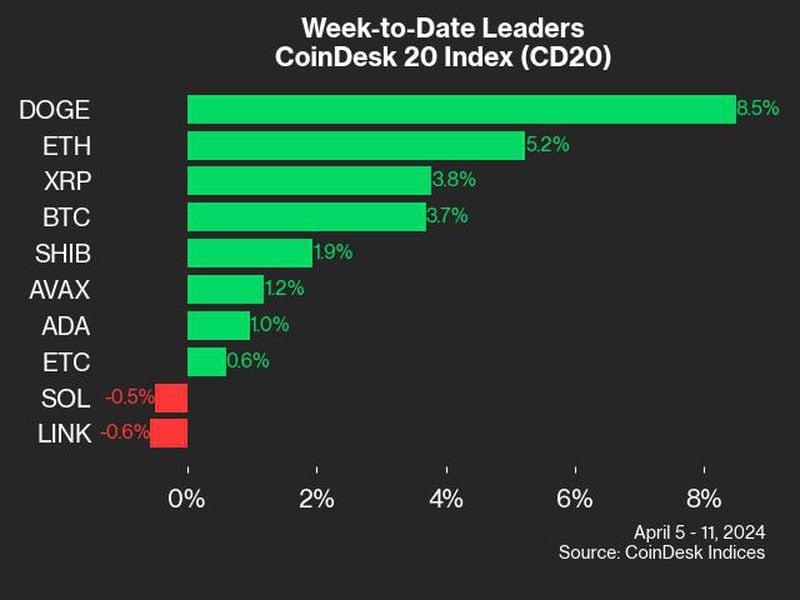

Dogecoin Climbs 5.4%, Tops CoinDesk 20 This Week: CoinDesk Indices Market Update

Post Content Read more

-

Avail, Blockchain Data Availability Project, Sketches Out Eligibility for Token Airdrop

A screenshot of a document describing the eligibility criteria for the airdrop was posted on the social-media platform X by… Read more

Current Event

-

Compete in the 8V Futures Trading Challenge and Win Big!

Dear 8V Users, To foster user interaction and competition, and to enhance your experience with our futures trading services, we… Read more

-

Game-Fi Challenge: the more you Play, the more you Earn! round three

Dear 8V users, Every day, as the cryptocurrency market fluctuates, you are faced with the decision of whether to trade… Read more

-

Crypto gift bag for beginners

Dear 8V Users, To provide a better trading experience for our new users, 8V invites you to participate in our… Read more

-

“Small-Scale Wealth Management x New Year Financial Planning” to Kickstart Your Fortune in the New Year!

Dear 8V Users, Welcome to our beginner’s USDT Wealth Management Event! As a popular asset in the cryptocurrency market, USDT… Read more

Announcements

-

Announcement on supporting BNB Smart Chain (BEP20) network upgrade and hard fork

Dear 8V users: In order to provide a high-quality user experience, 8V will support BNB Smart Chain (BEP20) network upgrades… Read more

-

Support for the deposit and withdrawal of USDC tokens on Tron Network (TRC20) has been stopped.

Dear 8V users: Based on the fact that the Circle team has stopped supporting the USDC token of Tron Network… Read more

-

Updates on the delisting of token withdrawal services, and the announcement of the conversion of YFII and SRM to USDT

Dear 8V users: 8V will convert the following token balances into equivalent USDT based on the user’s holdings in the… Read more

-

【Announcement on the addition of U-standard contract trading pairs】

8V will be released on April 5, 2024 1000PEPE/USDT 1000FLOKI/USDT WIF/USDT U-based contract trading pair Warm reminder: Since the above… Read more